Santa Monica residents will soon cast their votes to determine the destiny of four city council members as well as the outcome of four ballot measures. While the general election occurs on November 5, 2024, voters can register by October 21 to receive a vote-by-mail ballot. For information about voting centers and ballot drop boxes, please visit this site.

Measure F

Measure F is a business license tax that will fund essential city services surrounding public safety, homelessness, and 911 emergency response. It revises Santa Monica’s outdated 1990 business license tax ordinance to promote tax equity, reflect economic changes that include remote work and online businesses, and ensure that smaller businesses do not face an unfair tax burden. Businesses earning less than $100,000 in gross revenue will be exempt from the business license tax.

The measure will raise the corporate headquarters rate to 0.25 percent, remove auto dealer tax exemptions, decrease tax rates for most retailers and restaurants, and restore a business license processing fee. The business license tax increase would be phased in incrementally over three years. Expected to generate $3 million annually for the city’s general fund, the revenue can be used for any governmental purposes, including essential services for police, firefighters, parks and recreation, homelessness services, and 911 emergency response. If approved by more than a 50 percent majority, Measure F would go into effect on January 1, 2025.

Measure K

Measure K would increase the city’s parking facility tax by 8 percent (raising it from 10 percent to 18 percent) and would apply to parking fees paid at privately owned garages and lots, not city-owned lots. If the measure is adopted, the parking facility tax rate at city-owned lots and structures will remain at the existing 10 percent rate. Expected to generate $6.7 million annually for the city’s general fund, the revenue is intended to maintain essential city services, enhance public safety, create safe routes to school to protect children, and lower the risk of fatal traffic accidents. The measure is supported by police officers, firefighters, school parents, and Santa Monicans for Renters’ Rights. If approved by more than a 50 percent majority, Measure K would go into effect on January 1, 2025.

Measure PSK

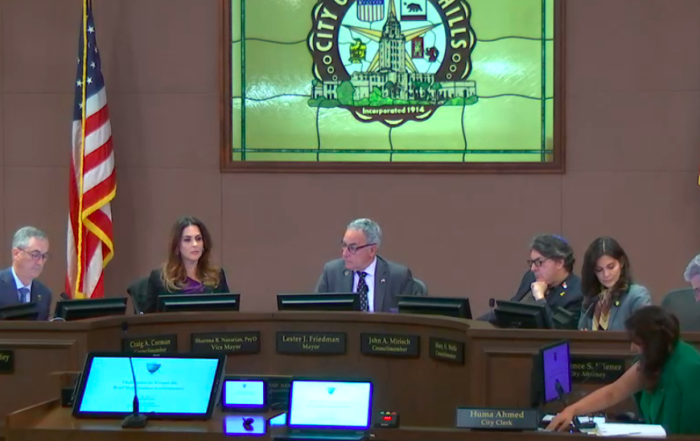

Measure PSK is an advisory measure that accompanies Measure K, allowing voters to provide insight to the City Council regarding how to spend half of the $6.7 million raised through Measure K. The measure asks voters whether half of the new revenue should be spent on enhanced public safety, such as increasing police patrols, retaining police officers and firefighters, addressing crime and homelessness, and improving emergency medical response in public areas and neighborhoods. As an advisory measure, its passage would provide advice to the City Council but would not legally require the revenues to be spent in any particular way. The measure is supported by Santa Monica City Councilmembers Jesse Zwick and Caroline Torosis, and Bob’s Market.

Measure QS

Measure QS is a $495 million bond measure that would raise $28 million annually to pay for repairs and upgrades for schools in the Santa-Monica Malibu Unified School District. It would entail an estimated property tax levy of $30 per $100,000 in assessed value, and it requires approval by a 55 percent majority. For more information about the school bonds, please see Hannah Bowlus’s article here.

Due to a registrar error, Santa Monica voters should remember to vote only for Measure QS, and not Measure MM, which applies solely to Malibu voters.

For more information on the measures, please visit the following link: https://www.santamonica.gov/elections/2024-11-05/measures

Photo by Darylann Elmi on iStockphoto.com

Stay informed. Sign up for The Westside Voice Newsletter

By clicking submit, you agree to share your email address with Westside Voice. We do not sell or share your information with anyone.