The West Hollywood City Council voted Monday night to adopt a 2024 Economic Study designed to assess the city’s economic health, identify strengths and weaknesses, and formulate strategies to support all sectors of the local economy with a five-year plan.

The report was created with input from community stakeholders, including businesses, labor unions, advocates, residents, and city staff. The study drew upon data in real estate, employment, and demographics.

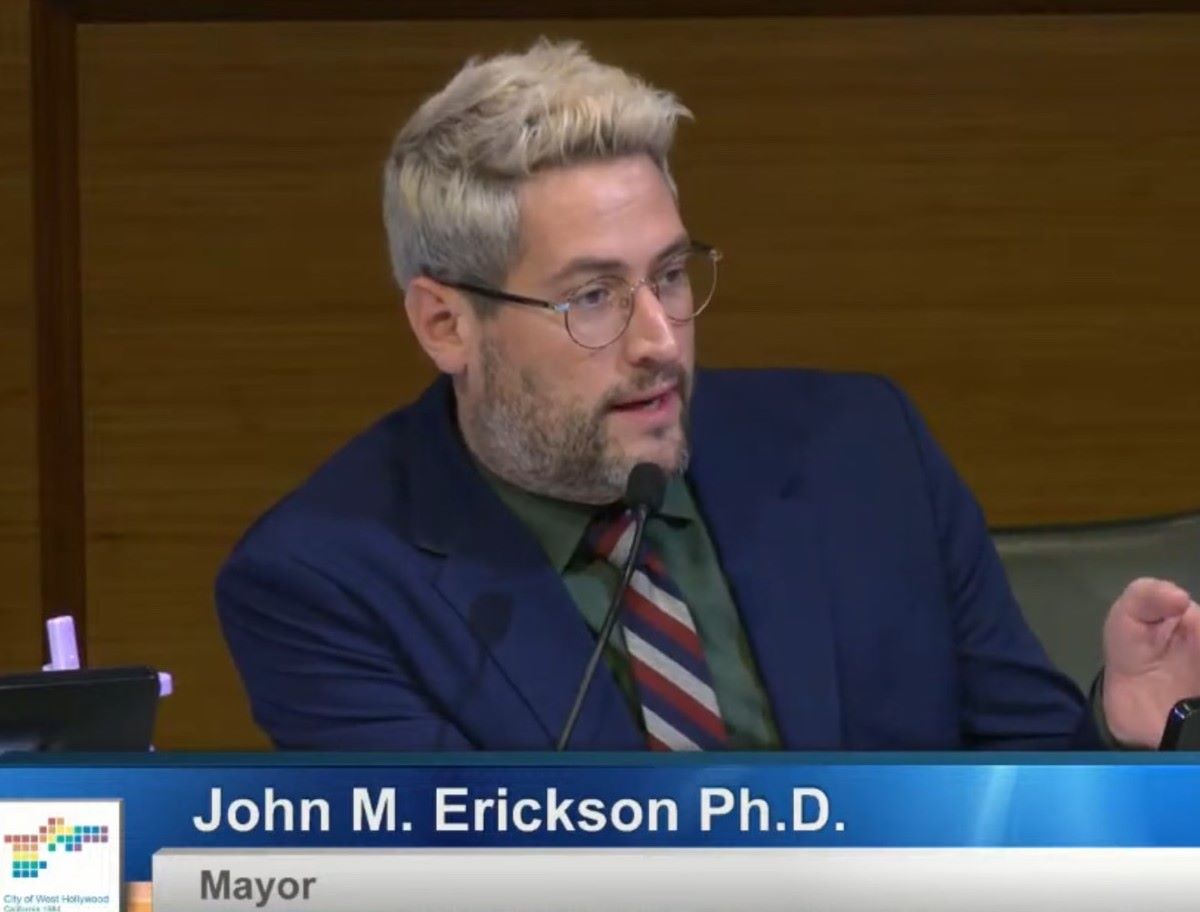

“I think this is a nice roadmap for where we have to go, and as someone who lives on the east side I would love to see where this development can go,” said Mayor John Erickson.

The Findings

West Hollywood is currently home to 35,000 people and has over 1,500 brick-and-mortar businesses and over 500 home-based businesses. According to the study, about 95 percent of West Hollywood’s workforce commutes into the city, while 93 percent of residents commute to jobs outside the city.

Tourism is the leading economic driver for the city, contributes significant tax revenues, generates jobs, and attracts millions of visitors annually who patronize local businesses. In fiscal year (FY) 2023-2024, West Hollywood captured $9.5 million in sales tax revenue from consumers living outside the city.

In 2023, there were 4.9 million visitors to West Hollywood. The top three destinations were – the Sunset Plaza – which received 325,000 visitors. West Hollywood Park came in second with 250,000, and Saddle Ranch came in at 230,000.

There are currently 19 hotels throughout the city. The average nightly rate for a hotel in the city in 2023 was $381 according to the study.

Almost a quarter of jobs in the city are in hotels, restaurants, bars, and other accommodations and food service sector businesses. The Sunset Strip is West Hollywood’s hospitality and tourism hub, and 62 percent of the hotels in the city are located on the Strip. There was a total of $3.2 million in taxable sales in Q1-Q3 2023, and 44 percent of all visits in 2023 to West Hollywood included trips to the Sunset Strip.

A substantial portion of West Hollywood’s municipal revenue is derived from the Transient Occupancy Tax (TOT) paid by guests staying in West Hollywood hotels. The TOT brought in $32 million and was the highest revenue earner for the city. Hotel and sales taxes accounted for 58 percent of city revenues in FY 2022.

The eastside is home to West Hollywood’s Russian-speaking population and bakeries, grocery stores, and other businesses serving that community. The east side relies more heavily on spending by residents and employees. Businesses on the east side face competition from nearby areas with more robust retail offerings, contributing to “economic leakage.”

The east side’s economic growth was a substantial 99 percent from FY 2013 to Q1 2024. Forty percent of visitors from the eastside live within two miles of the city.

Westside neighborhoods received 70 percent of total visitation to West Hollywood in 2023.

While average retail rents across the city have fallen slightly since peaking in 2021, West Hollywood retail rents remain high compared to competitive markets and are especially higher in Westside neighborhoods receiving more foot traffic.

Many businesses closed during and as a result of the COVID-19 pandemic. Rising costs – including rent, insurance, materials, labor, and more – have forced others to close, and those remaining to adapt by raising prices, reducing services, or otherwise changing their operations.

West Hollywood’s unemployment rate sits at 6.4 percent, the highest among Westside cities.

While lower than its pandemic high, the city’s retail vacancy rate has not fully recovered to pre-pandemic levels, and as of Q1 2024 was the highest among its neighbors at 9.2 percent. Labor costs are high, driven in part by West Hollywood’s minimum wage ordinance and paid time off requirements.

The study also found that shifting consumer preferences such as trends around reduced alcohol consumption and dating apps as an alternative to bars and other third spaces to meet new people have presented challenges.

Hybrid and remote work trends are also among the factors driving reductions in foot traffic, especially around offices, impacting office properties themselves, as well as lunchtime businesses whose customer base included office workers now coming in less frequently due to those trends, according to the study.

Offices in West Hollywood have faced an increasing vacancy rate over the past four years, at 15.3 percent as of Q1 2024.

According to the study, the city’s high retail vacancy rate is detrimental to the local economy. Remote work, rising vacancies, and continued uncertainty in the office market render ground-up office development infeasible for the foreseeable future.

Image obtained via screen capture.

Stay informed. Sign up for The Westside Voice Newsletter

By clicking submit, you agree to share your email address with Westside Voice. We do not sell or share your information with anyone.